Taxes, everything Cryptocurrencies like Bitcoin and Ethereum stand against. A centralized tax on a deregulated currency sounds oxymoronic to the ears. Despite this, I get asked about the new taxes the United States Internal Revenue Service recently announced and can understand the confusion. The truth is that tax and cryptocurrency are nothing new and the IRS has had a Frequently Asked Questions about cryptocurrency since 2014. Since these are relatively new laws, it is much less complicated than to backtrack and find what rules are current.

The Federal government recognizes virtual currency as property and is treated as such. As far your own Bitcoin spending and crypto-based taxable responsibilities are concerned, the IRS expects you to treat it as any other domestic property exchanged for goods or services, and or, sold for loss or profit. Before you get ready to file your tax returns as normal, there are some critical distinctions that the IRS has made about reporting investment income activity the selling of virtual currency in regards to this 2014 IRS Notice.

In general, the sale or exchange of convertible virtual currency, or the use of convertible virtual currency to pay for goods or services in a real-world economy transaction, has tax consequences that may result in a tax liability. This notice addresses only the U.S. federal tax consequences of transactions in, or transactions that use, convertible virtual currency, and the term “virtual currency” as used in Section 4 refers only to convertible virtual currency. No inference should be drawn with respect to virtual currencies not described in this notice.

The IRS expects you to keep accurate investing records. So if you are one of the thousands of people who joined the cryptocurrency community within the past three years, Uncle Sam expects you to amend your previous year’s return for the last three years, or from two years to the date of final payment on that year’s tax liability. To do this, just file Form 1040X, Amended Tax Return, along with the corrected or additional documents you did not originally file with your return. If you think that this may be a big bother over nothing, maybe I should remind you of this.

Most people are finally asking questions about virtual currency tax liabilities because of the profits made from the recent swelling of Bitcoin and Ethereuem market caps. The Federal Government knows that these markets are stabilizing at these historic highs, giving early investors ample opportunity to convert those extremely high returns to U.S. Dollars. As Fortune reported, Through an Investigation and federal summons and ugly lawsuits with the exchange Coinbase, the IRS found out that less 1,000 people were actually following through on their crypto-tax responsibilities.

IRS agent David Utzke reveals additional information about how the agency is conducting the investigation. Specifically, Utzke explains he ran a computer analysis against the IRS’s repository of hundreds of millions of tax records, and found fewer than a thousand people filed a Form 8949 to account for a “property description likely related to bitcoin.

Fortune.com – Jeff John Roberts -” Only 802 People Told the IRS About Bitcoin”

Mar 19, 2017

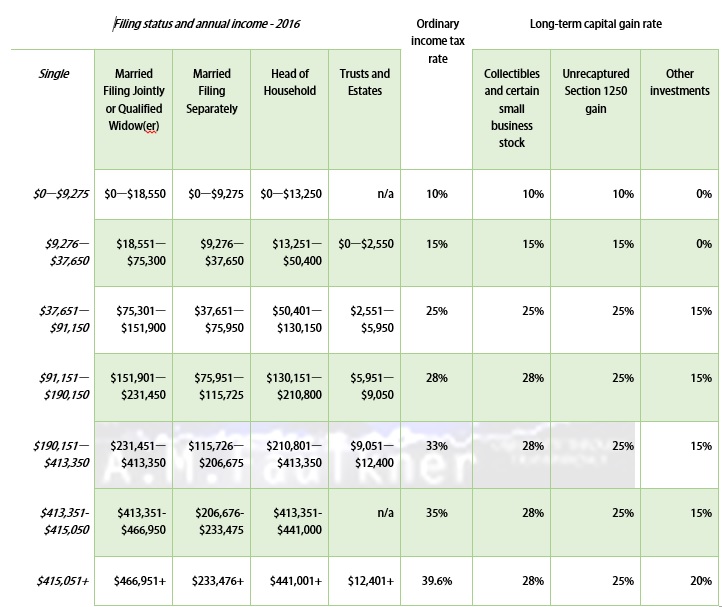

2016 Filing Status And Income

As with most investment income, profits from selling or converting virtual currency or stock held less than a year are considered short-term and typically taxed at the taxpayer’s Ordinary Tax Rate *see above. In the Case of Long-Term holdings, or more than one-year, The levy on the sell-for-profit of cryptocurrency is 10% to 15%, unless the filer is classified a High-Income Taxpayer, then the tax becomes 25% to 28%

Please remember that this is not investment or tax advice. You should check with your own tax professional in regards to converting between other virtual currencies or the Treasury Department and IRS, who understand that taxpayers may have questions. The appropriate contact information for an IRS opinion on this topic is, Notice.Comments@irscounsel.treas.gov. Taxpayers should include “Notice 2014-21” in the subject line. OR alternatively:

Internal Revenue Service Attn: CC:PA:LPD:PR (Notice 2014-21)

Room 5203 P.O. Box 7604

Ben Franklin Station Washington, D.C. 20044

Thank you for reading, I plan to follow this up with another installment soon, soon please follow this blog and leave your questions in the comments section below. If you feel like this has helped you and you would like to support this blog.

Bitcoin: 1Q5v1vUT9YXMB9aWz85HfYrpBeGywH3bxk.

Ethereum: 0x13cF24A3636568Bd0f15CFDdDEaE3D8d6261aeb2

Follow me on Twitter. @a_m_faulkner

and check our cryptocurrency discussion group on facebook.

Happy Mining, Good Luck Trading Everyone.

-AMF

Bitcoin.com has done

Bitcoin.com has done

You must be logged in to post a comment.